Suggested Search

What happened this year in the world of finance and super?

Get caught up on the key moments of 2024 and learn how they might impact your financial future in 2025 and beyond, with our CFS Super Wrapped webinar.

Discover highlights of the year, important updates to your super, and insights on how markets shaped our investment performance.

Education and webinars: What we covered in 2024

In 2024, we delivered a range of sessions to help you better understand economic markets, and take greater control of your financial future.

This included practical, actionable topics, like how to boost your super and take advantage of tax cuts, as well as hot topics that members wanted to learn more about, like cryptocurrency and bitcoin.

You can explore the sessions and watch them on demand.

Did you know that you're getting more super now?

In 2024, Australians started getting paid more super.

The money your employer has to contribute into your super account is called the superannuation guarantee. This amount increased to 11.5% of your pay (before tax) for the 2023-24 financial year.

This amount is being gradually increased over time, and In 2025, it will increase again. From 1 July 2025 it will be 12%.

The impact of these small increases can be significant over time. This table shows the extra money you can earn from just a 0.5% increase, based on a $100 000 salary.

10 year result

$4,910

15 year result

$7,988

20 year result

$11,572

Assumptions

Super Guarantee:

- SG calculated on $100,000 salary, comparing 11.5% SG in all years v 12% SG in all years.

- Results discounted to todays $ assuming inflation of 2.5%.

This year's tax cuts left Australians with more money in their pockets

What if someone earning $100,000 a year invested approximately half of their tax cut? ($1,200 per year)

How does this compare to paying off your mortgage or making investments outside of super?

Take a look at our coverage of the stage 3 tax cuts to learn more.

What do Stage 3 Tax cuts mean for you?

The table below projects what a $1200 investment could look like over time invested in super, your home loan, or an investment other than super.

10 year result

$17,330

$13,380

$14,539

15 year result

$28,191

$21,409

$24,304

20 year result

$40,842

$30,528

$36,234

Assumptions

Concessional contributions:

- Assumes earnings of 3.5% income and 3.0% gains.

- Gains assumed to be taxed at 10%.

- MTR assumed to be 32% including Medicare levy.

- Contributions indexed by 2.5% each year.

- Results discounted todays $ assuming inflation of 2.5%.

Want a deeper investment update for 2024? Check out our December market insights

Hello and welcome to CFS Market Insights. I'm Jonathan Armitage and I'm joined by Al Clark.

We're going to start off by talking about investment performance, and we've seen another year of very strong returns from markets, particularly from equities.

Global equities are up nearly 28%, domestic equities are not that far behind, and that means that overall, we're seeing some really exceptional returns for our members and other investors. And it's worth sort of touching on some of the drivers behind what's been going on with equities in particular, a lot of it's been around technology.

But it's not just been around tech, we've seen some very strong returns from healthcare companies. But Al it'll be interesting to get your thoughts on some of the real very strong drivers to investment performance.

Yeah, and you’re right it's an extension of the similar theme we've talked about before, which is the generative AI boom, so it's the tech companies who have been the leaders in this. But we are, and we've talked about this, we are seeing some broadening out of equity market performance. So, it's not just the ‘Magnificent 7’ as they've been coined, although they have done incredibly well, there are other parts of the market and not just the US market doing quite well.

So, as you said, Australia's done okay, emerging markets are starting to come along for the ride, small companies have done really well, which has been one of our key topics as well. So, it's been a bit of a broadening out of equity markets. That said though, it's worth highlighting that those Magnificent 7 have remained magnificent, and in particular Nvidia. So this company, so this is at the picks and shovels of this whole AI boom, has grown from $300 billion to now $3.5 trillion in 2 years.

So that's since ChatGPT was released in November 2022, it's grown $3.2 trillion, that company. To put that in context, the biggest company in Australia is CBA, it's $260 billion. So Nvidia in two years has put on somewhere in the order of 12 to 13 CBA's, so it's been an exceptional performance from an amazing company.

Yeah, I think that perspective is very important, and I think it just highlights some of the extraordinary growth that you're seeing from these companies, not just Nvidia, but all those which are connected with the generative AI boom.

So, the next thing that is worth talking about is elections, and 2024 has been an extraordinary year for elections, the biggest series of elections in democratic nations ever. And we talked about this at the start of the year that, something like 80% of the world's eligible voters were likely to go to the polls at some point during the year.

So, I think it's worth sort of just, reflecting a little bit on what's happened. One of the things that is, I think, really noteworthy is that in all democracies which have had elections the incumbent government have either been kicked out or have lost material amounts of the vote. And you've seen big swings in the UK, I think you've seen the largest ever swing in terms of constituencies away from the previous government to the new government. But significant moves in countries like France, we’ll come onto the US in a moment. But it's also sort of part of this sort of shift to populism, and the fact that governments are finding the issues around the cost of living very challenging to deal with.

Yeah, and I think that is the most important point, cost of living. So, inflation is pernicious, so it just hits everyone. So, if you're a government and you introduce a policy to change negative gearing or to change franking credits, you impact maybe somewhere between 5- 15% of the population. Cost of living, so what you pay at the petrol pump, or what you pay for electricity, hits 100% of the population. And so, when that's going badly, it's really hard for incumbent governments to go well.

Yeah, I think it's very difficult for politicians to deal with as well.

And I think that that's been the sort of narrative that you've seen, throughout this year, and it's been something that we've talked about quite a lot. It's one of the reasons why we've continued to build in diversification into CFS’s as portfolios. And so, notwithstanding that you've seen quite a few changes in governments, this sort of issue around underlying inflationary pressures, we think is going to continue to be a feature going forward.

Yeah, and there's a chance that what's happened with the US and Trump's policy program, it's just going to make that even more of a problem going forward.

So, I think that probably brings us on to talking about the US election. I mean, some observations is that, regardless of what one might think about either the individual or his policies, it's quite clear that Trump has been given a mandate by the US electorate.

He won the Electoral College, the popular vote, although by not as much as everyone sort of thought at the time, and both parts of Congress. Although the grip of the Republican Party on the House of Representatives is perhaps a little bit more tenuous than I think people really understand.

We can talk a little bit about some of the areas that Trump’s sort of focusing on. There's been a lot of talk since the election about tariffs, and the impact that that might have on certain economies. Migration policies, again, it's very difficult to know how this is going to sort of play out. But one of the things that we are going to be watching quite closely is the way that the reduction in migration and the removal of illegal immigrants will impact the labour market. Tax cuts, deregulation, those have all been really positive for equity markets, and I think that's been sort of part and parcel of the recent rally.

But it does seem that we're going to have to get used again to the fact that policy is going to come by social media. So, I think it'd be good to get your thoughts on what do you think Trump administration is going to mean for markets.

Yeah, it's fascinating because you're right, we're not really sure. He’s said a lot about what he wants to do, and the US population is potentially giving him a mandate to then do those things. How much of those can you actually get done?

So, the first two you talked about, the tariffs, and the exporting the illegals, so the immigration piece, they're by nature inflationary, so that's working against what they maybe want to do.

But then, as you said, the tax cuts and the fiscal policy, and then the deregulation, they're pro-growth. So, they could potentially reduce inflation as well. So, it's a real balance. At the moment we need to really try and get some more detail on what’s going on, how this is actually going to play out.

Australia might not be in the crosshairs for this because we don't have a big, they call it a trade balance or a negative trade balance, with the US. So, we don't have a large negative trade balance, so Australia might stay out of the crosshairs. China is definitely in the crosshairs, that's really important for Australia because China is our biggest trade partner by multiples, our biggest import and export partner.

So, what happens with China, indirectly, secondary effects, indirectly affects Australia. So, we need to be mindful of watching the types of policy that they're impacting and how they're impacting China, because that will have knock on effects to exactly how Australia behaves.

So, I think it's hard given we don't have any real transparency on how the policy is going to play out, it's hard to know with any clear conviction which way to jump with this, but maybe the one thing we are keen to do in our portfolios is to remove any unrewarded risks. So if, for instance, Trump suddenly puts huge tariffs on Europe, well then European currency is going to perform poorly, European equities are going to perform poorly. For us, we need to just make sure where we can hedge those risks, so maybe the currency is an easy way to do it, we need to get rid of those unrewarded risks as we work our way through what is really going to be quite a volatile potential environment.

I think that's important, and it's a sort of key thing, is that part of our investment process is not to sort of bet on one particular outcome, but understand that, the market situations probably, may well end up being quite fluid. And the way that you are able to manage that, from an investment perspective, is through diversification and different building blocks within our investment portfolios.

So really, in conclusion, we've had another extraordinary year. We've had two years of fantastic returns for members, which is a great outcome. I think one of the things that is worth reminding people is how unusual the last couple of years have been.

We normally see returns around sort of eight 8-9% per annum for super funds. For the last couple of years, those have been sort of well into the sort of high teens. And I think it's just a reminder that, first of all, we have had these sort of exceptional periods of investment performance, Al talked about the impact of companies like Nvidia and the very strong growth that they produced.

But this is highly unusual, and I think it's worth reminding people that we should expect some probably, more normalised returns as we go forward.

We think that we're well positioned to help manage that. We've talked about sort of some of the challenges in terms of predicting what might occur with the new Trump administration. But the diversification we've put into our portfolios, we think, means that those portfolios, have built in quite a bit of resiliency, and we think our members will be well served by that going forward.

Thanks for watching CFS Market Insights. See you next time.

Heard about our outstanding performance this year?

Breaking news: CFS ranked #1

Independent research bodies, SuperRatings and Chant West have released 2023-24 super fund performance scorecards. CFS has been recognised for strong performance including:

- CFS placed #1 and #2 by SuperRatings in the best performing MySuper Lifecycle investment options.**

- Chant West placed CFS equal first in the Top 10 Performing Growth Funds.#

- CFS Enhanced Index Balanced option achieved number three in top fifty balanced options (SuperRatings).**

That wraps up 2024!

Thank you for joining us on your super journey this year. Keep an eye out for our 2025 education calendar. You can also explore the additional resources below to continue making the most of your super.

How much super

should I have?

Discover how much super you'll need to enjoy the retirement you want, and super-boosting strategies that can help you reach your goals.

Explore

retirement

Take control of your retirement story and create a plan for your financial freedom. Get the tools and support to enjoy the retirement of your dreams.

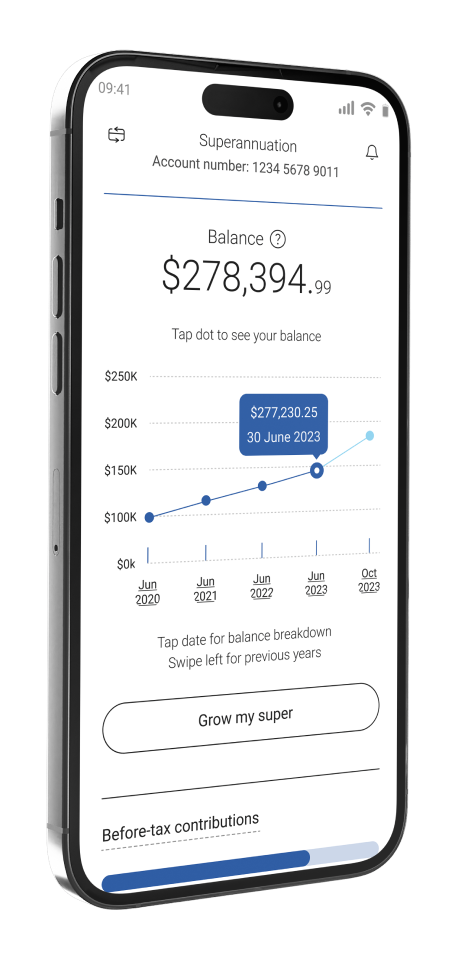

Download the

mobile app

Track your super and investment performance with ease and enjoy 24/7 access to all your CFS accounts.

Unleash in ways you never thought possible

Get in touch

Get in touch with us online or call us

8:30am to 6pm AEST Monday to Friday.

Find a financial adviser

Use our tool to find professional financial advice,

local to you.

Download mobile app

Track your balance and see your

transactions history from anywhere.

Past performance is no indication of future performance.

* Based on admin fee for FirstChoice Wholesale Personal Super (excl. FirstRate options) and MySuper Products, Chant West December 2023 Super Fund fee Survey. Other fees apply.

** FirstChoice Essential Super growth option (MySuper Lifestage 1975-79) was the best performing MySuper Lifecycle option in FY24, delivering a 14.4% return, followed by FirstChoice Employer Super growth option (MySuper Lifestage 1975-79), which ranked second with a 14.3% return. As rated by research house SuperRatings.

# Chant West Top 10 Performing Growth Funds (year to June 2024) – CFS FirstChoice Choice Growth returned 10.7% equal to Mine Super and IOOF.

Avanteos Investments Limited ABN 20 096 259 979, AFSL 245531 (AIL) is the trustee of the Colonial First State FirstChoice Superannuation Trust ABN 26 458 298 557 and issuer of FirstChoice range of super and pension products. This document may include general advice but does not consider your individual objectives, financial situation, needs or tax circumstances. You can find the Target Market Determinations (TMD) for our financial products at www.cfs.com.au/tmd, which include a description of who a financial product might suit. You should read the relevant Product Disclosure Statement (PDS) and Financial Services Guide (FSG) carefully, assess whether the information is appropriate for you, and consider talking to a financial adviser before making an investment decision. You can get the PDS and FSG at www.cfs.com.au or by calling us on 13 13 36.