Suggested Search

Stage 3 tax cuts mean that every Australian taxpayer will have some extra cash available to them from 1 July 2024 onwards – but what’s the best way to spend, or invest, this additional money? Watch our webinar to learn a few simple strategies that can help you plan ahead and make informed investment choices based on your financial situation, and your long-term goals.

Understanding Stage 3 tax cuts

The amount of tax you save will depend on your total income. Find out how the stage 3 tax cuts work, and how much you can save in tax benefits.

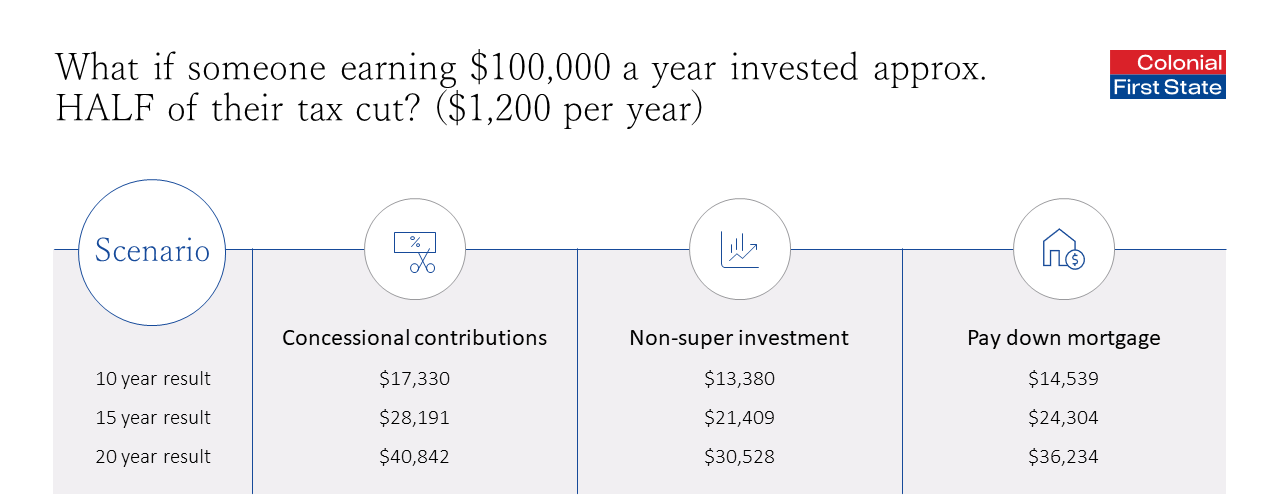

How do my investment options compare?

What should you do with your extra money? Find out how paying down your mortgage, making a general investment, or topping up your super stack up dollar for dollar in the long-run.

Topping up my super

There are different strategies for boosting your super, with considerations and benefits around each method – find out how you can get the most out of your super, and set yourself up for the best long-term investment.

Tax savings

The amount of tax you will save depends on your level of taxable income.

The table below compares the amount of tax you will pay in 2023/24 to the amount payable under the new tax rates from 2024/25.

$1,542

$1,188

$354

$4,767

$3,963

$804

$13,217

$11,788

$1,429

$22,967

$20,788

$2,179

$40,567

$36,838

$3,729

$56,167

$51,638

$4,529

Note: these amounts do not include Medicare levy

![]()

Assumptions

Deductible contributions:

• Assumes earnings of 3.5% income and 3.0% gains.

• Gains assumed to be taxed at 10%.

• MTR assumed to be 32% including Medicare levy.

• Contribution indexed by 2.5% each year.

• Results discounted to today's $ assuming inflation of 2.5%

Non-super investment:

• Assumes earnings of 3.5% income and 3.0% gains. 50% of gain assumed to be taxed at MTR in last year.

• MTR assumed to be 32% including Medicare levy.

• Contribution indexed by 2.5% every year.

• Results discounted to today's $ assuming inflation of 2.5%.

Pay down mortgage:

• Assumes loan amount of $500,000, interest rate of 6.49% over 25 years.

• 12 payments per year (300 totally), $3,371.91 payment per period and a tax cut benefit of $100 per month.

• Results discounted discounted to today's $ assuming inflation of 2.5%.

Resources referred to in the webinar

What’s next?

Speak to an expert

Our dedicated team of retirement specialists can provide general advice and help with a range of topics related to your retirement.

Retirement Calculator

Quickly and easily estimate how much super you may have in retirement and how much you may need.

Unleash in ways you never thought possible

Get in touch

Get in touch with us online or call us

8:30am to 6pm AEST Monday to Friday.

Find a financial adviser

Use our tool to find professional financial advice,

local to you.

Download mobile app

Track your balance and see your

transactions history from anywhere.

Information on this webpage is provided Avanteos Investments Limited ABN 20 096 259 979, AFSL 245531 and Colonial First State Investments Limited ABN 98 002 348 352, AFSL 232468. It may include general advice but does not consider your individual objectives, financial situation, needs or tax circumstances. You can find the target market determinations (TMD) for our financial products at www.cfs.com.au/tmd, which include a description of who a financial product might suit. You should read the relevant Product Disclosure Statement (PDS) and Financial Services Guide (FSG) carefully, assess whether the information is appropriate for you, and consider talking to a financial adviser before making an investment decision. You can get the PDS and FSG at www.cfs.com.au or by calling us on 13 13 36. This information is based on current requirements and laws as at the date of publication. Published as at 04 June 2024.