Suggested Search

Buying shares is simply buying into a business in the hope of sharing in its future success. While shares are classed as a growth asset and therefore carry a higher level of risk, becoming a share investor can be an easy way to grow your savings over the long term – even if you only start small.

How do sharemarkets work?

As a shareholder you become a part-owner of a listed company whose shares can be bought and sold on a stock exchange.

What is a stock exchange?

The world’s stock exchanges are marketplaces for trading shares and other financial products. Most originated as physical buildings but many have switched to becoming online platforms since share trading is now conducted electronically.

The New York Stock Exchange is by far the world’s biggest, followed by the US NASDAQ exchange which trades technology stocks. Australian shares are traded on the Australian Securities Exchange, or ASX.

How do shares generate investment returns?

As a shareholder you’ll receive a portion of the company’s earnings and profits (assuming it has made a profit) in the form of dividends. You’ll also get a say in how the company is run by voting at its annual general meeting.

Investors buy some shares specifically for the high dividends they pay, but most shares are bought in the hope that the company’s share price will rise and the investor can sell their shares at a profit. Shares therefore generate investment returns via a combination of income (dividends) and capital gains.

What are the different types of shares?

Listed companies around the world range from tiny start-up ventures to household names. Shares can be bought in companies across every industry, from mining to manufacturing, telecommunications to transport. You can invest in exciting new technologies like AI and robotics, and in traditional sectors like banking and retail.

If you’re starting out as a share investor you’ll need to decide whether to invest in Australian shares or international shares, or both.

Australian shares

The Australian sharemarket can be a good place to start investing because you’ll be familiar with many locally listed companies such as the big banks, retailers and mining companies. However, Australia’s sharemarket accounts for only about 2.5% of the world’s total. In other words, you’re missing out on 97.5% of investment opportunities.

If you plan to invest in shares by buying them directly yourself via a broker then the domestic market is the place to start.

International shares

The world’s biggest companies are all found beyond Australia’s shores, as are most of the small innovative companies with aspirations to grow into the big global brands of tomorrow.

Investing in international shares gives you access to more companies in different industries in different countries, and is therefore a great way to diversify your portfolio and benefit from growth opportunities not available in Australia.

What is currency risk?

Currency risk applies to international shares. It occurs when movements in the Australian dollar relative to the currency of the country where your shares are listed have a negative effect on your investment’s earnings or value. Investment managers can operate a strategy called ‘hedging’ to offset currency risk.

What are dividends?

Paying dividends is the main way listed companies return profits to their shareholders, usually in twice-yearly payments. How much each shareholder gets is simply the number of shares they hold multiplied by the dividend per share. For example, if a dividend payment is 13 cents per share, a shareholder with 1,000 shares will receive $130.

Share dividends are assessed as taxable income by the Australian Taxation Office. If a dividend is ‘franked’, or carries ‘franking credits’, it means the company has already paid tax on it, potentially reducing your tax liability.

Dividends are paid directly into your bank account. Some companies also offer the option to automatically reinvest your dividend to buy more shares.

What is market volatility?

Sharemarkets are said to be volatile when the price of shares fluctuates rapidly over a short period. The term ‘market volatility’ is mostly used when markets are falling steeply, such as during the global financial crisis or at the start of the COVID-19 pandemic.

Why do share prices change?

Share prices of frequently traded companies can change continually during the hours its stock exchange is open. Prices move up or down according to supply and demand – if more people are buying than selling then the price will rise, and vice versa.

A period of overall rising sharemarkets is known in the industry as a bull market, and falling prices indicates a bear market.

Factors affecting share prices fall into three broad categories:

1. Economic, political and environmental changes:

- Interest rate movements

- Regulatory or legal changes

- War or political instability

- Foreign currency fluctuations

- Disruption from extreme weather events.

2. Changes at individual company level:

- Better or worse than expected profit results

- Changes to key personnel or company strategy

- Reputational damage from legal action or media coverage

- Greater competition from new or rival companies

- New trends or technology making a company’s products unpopular or obsolete.

3. Overall market sentiment:

Sharemarket investors don’t always act rationally. Emotion and herd mentality play a big part in creating price volatility. Rumour and speculation can spark buying frenzies for certain stocks, driving prices to absurd heights only to crash back down. Pessimism can turn to collective panic and mass selling, sparking sharemarket crashes of the kind we saw during the global financial crisis or the Black Monday crash in 1987.

For beginner investors it’s important – though not always easy – to ignore the noise and not overreact to market volatility and make hasty decisions. For most people, sharemarket investing is a long-term strategy which means holding your nerve in periods of volatility.

How to invest in shares?

Broadly there are two ways you can invest in shares: either by buying them directly yourself, or indirectly via a managed fund or similar type of investment.

Buying shares directly

You can buy shares through a stockbroker, of which there are two kinds:

- Full-service brokers, who can advise you on what shares to buy and arrange your trade on the stock exchange in return for a fee

- Online share trading platforms, which don’t provide advice but will charge a set fee per transaction, which could be as little as $30 or even less.

How much do I need to buy shares directly?

To buy shares on the ASX you need a minimum investment of $500. Most full-service brokers will have higher minimums than online trading platforms.

Buying shares indirectly

The following financial products let you invest in shares collectively with other investors rather than owning shares as an individual.

All three offer the benefits of diversification by letting you invest in many different companies for a relatively small outlay. They also let you easily invest in international shares, which is difficult to do on your own due to tax and legal reasons.

Managed share funds

Managed funds pool your money with other investors to buy shares in different companies. Instead of owning the shares yourself, you own units in the fund – how many you get depends on how much you invest and the unit price on that day.

Unit prices are re-calculated and changed once a day relative to how the underlying shares are doing. The dividends the fund receives from the companies it’s invested in are paid to unit holders as distributions.

Exchange traded funds (ETFs)

ETFs are similar to managed funds and are another way of gaining broad market coverage within one package. The key difference is that ETFs are themselves traded on the stock exchange, and their changing values are therefore shown in the same way as ordinary shares rather than as units in a fund. ETFs tend to invest ‘passively’ by tracking a sharemarket index and therefore tend to have low fees.

Listed investment companies (LICs)

Like ETFs, LICs let you invest in a ready-made share portfolio that is traded on the stock exchange. However, LICs tend to be more ‘actively’ managed, meaning they try to do better than a sharemarket index.

Unleash the investor inside you

What is the ASX 200 and the S&P 500?

The ASX 200 and S&P 500 are examples of share indexes. An index is made up of a set number of companies (200 and 500 in this case) whose performance is tracked, reflecting the collective upward or downward trend of the shares in the index.

Are shares a good investment?

Depending on your age and risk appetite, investing in shares can form the foundation of a successful long-term investment portfolio, and carries key features:

- Shares can easily be sold if you need quick access to your money (although potentially with tax implications)

- Like all growth assets, shares are riskier than defensive assets like cash and fixed interest investments, but their values are likely to grow more over time.

Head to our Understanding investment risk page to learn more about investment risk across different asset classes.

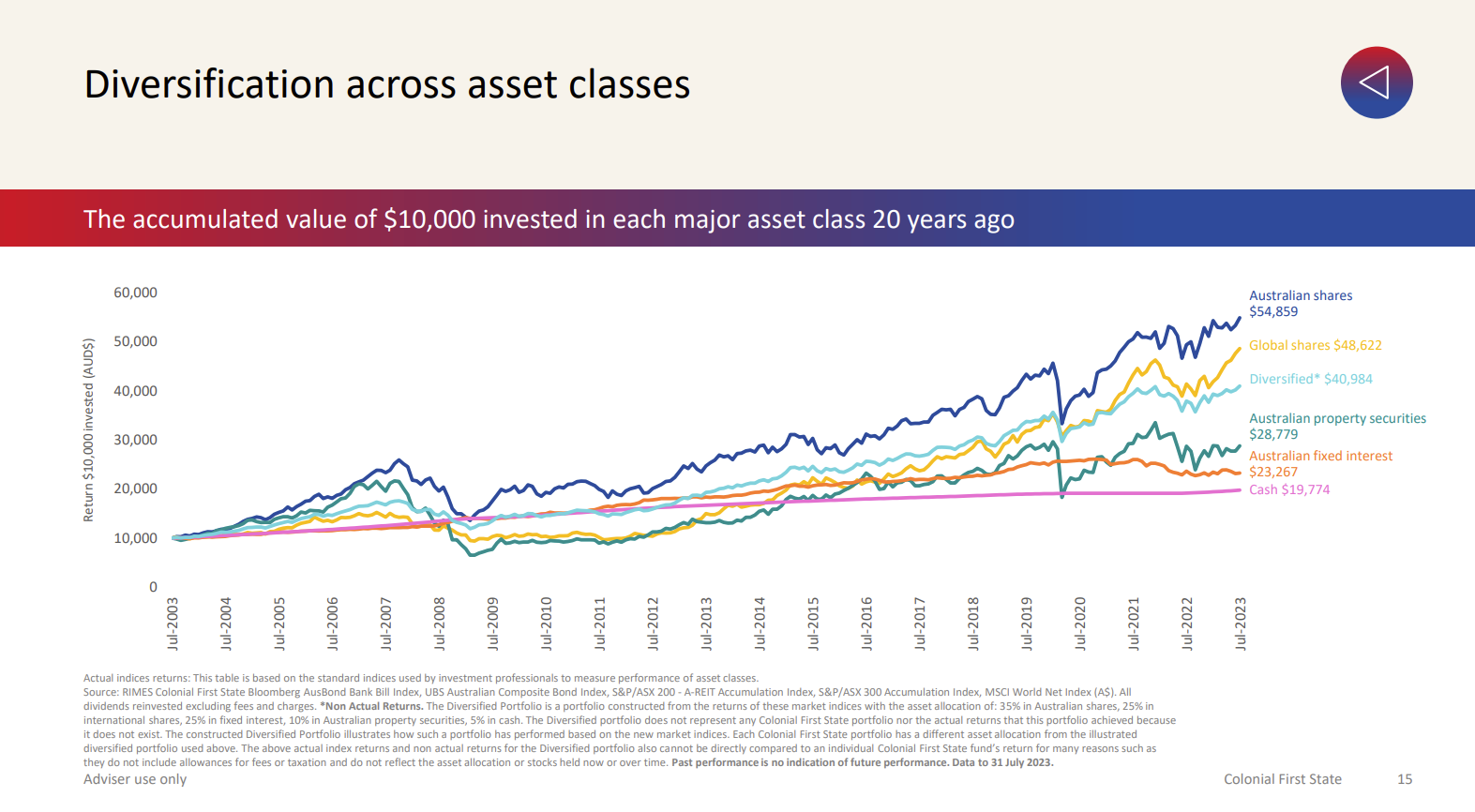

Historically, shares have shown a long-term upward growth trend despite being volatile along the way. Take a look at the chart below, which shows how shares have outperformed the other major asset classes over the past 20 years, despite some big fluctuations along the way.

For investors who are comfortable with taking on some risk and who intend to stay invested for the long term (generally at least seven years and ideally longer), shares can be a highly rewarding way of growing their long-term wealth.

What’s next?

Investing made simple

Learn everything you need to know to plan and start your investment journey.

Investment options

Learn about the different types of investments you can make and which might be right for you.

Investment glossary

Get your head around common financial and investment terms with our A-Z jargon buster.

Unleash in ways you never thought possible

Get in touch

Get in touch with us online or call us

8:30am to 6pm AEST Monday to Friday.

Find a financial adviser

Use our tool to find professional financial advice,

local to you.

Download mobile app

Track your balance and see your

transactions history from anywhere.

Things you should know

Avanteos Investments Limited ABN 20 096 259 979, AFSL 245531 (AIL) is the trustee of the Colonial First State FirstChoice Superannuation Trust ABN 26 458 298 557 and issuer of FirstChoice range of super and pension products. Colonial First State Investments Limited ABN 98 002 348 352, AFSL 232468 (CFSIL) is the responsible entity and issuer of products made available under FirstChoice Investments and FirstChoice Wholesale Investments.Information on this webpage is provided by AIL and CFSIL. It may include general advice but does not consider your individual objectives, financial situation, needs or tax circumstances. You can find the target market determinations (TMD) for our financial products at www.cfs.com.au/tmd, which include a description of who a financial product might suit. You should read the relevant Product Disclosure Statement (PDS) and Financial Services Guide (FSG) carefully, assess whether the information is appropriate for you, and consider talking to a financial adviser before making an investment decision. You can get the PDS and FSG at www.cfs.com.au or by calling us on 13 13 36.