The team screens the investable universe for essential infrastructure characteristics, analyses various factors through company research, and derives valuation inputs to develop tailored assumptions.

Suggested Search

Innovative real asset specialists leveraging market inefficiencies to deliver enticing, risk adjusted returns.

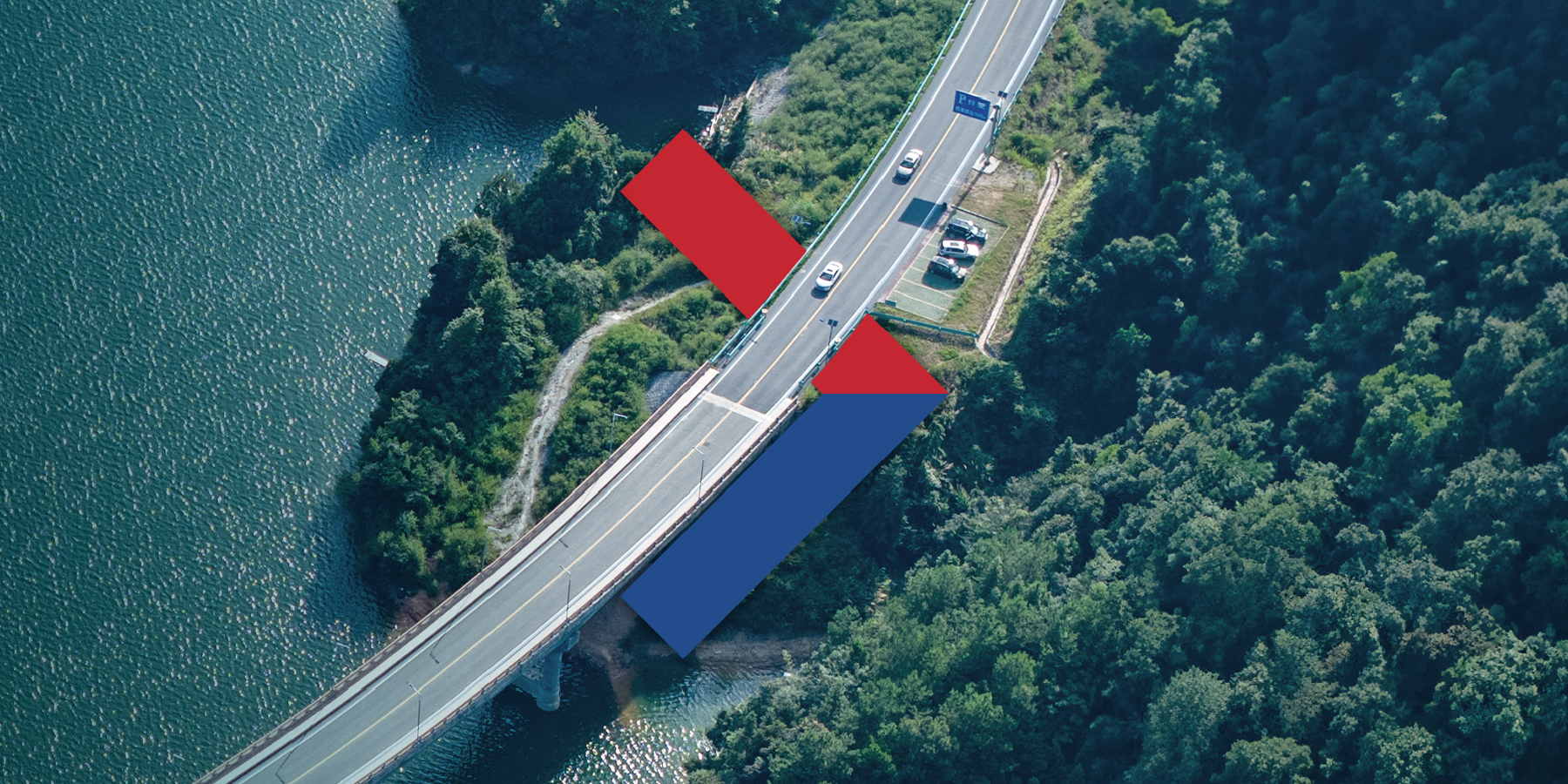

Equity-like returns with lower volatility

Listed infrastructure offers predictable cash flows and monopolistic market positions, resulting in equity-like returns with lower volatility.

Diversified return

profile

In challenging markets, listed infrastructure provides favourable downside capture, inflation protection, and appealing dividend yields.

Drivers of long-term

investment

Demand for infrastructure development drives economic and societal growth, creating long-term investment opportunities.

"Our tenure in the industry, the depth of our resources, and our scale have permitted us to deliver consistent alpha for our clients since 1986."

Matthew Pace

Executive Vice President at Cohen & Steers

Find out the benefits of investing in listed infrastructure with Cohen & Steers.

Investment philosophy

Cohen & Steers’ fundamental research process consistently generates high conviction investment ideas.

-

Research inputs

-

Sub-sector allocation framework

This involves ranking macroeconomic themes to assess attractiveness, determining subsector weights, and integrating macro team insights to refine and optimise sub-sector allocations.

-

Security selection

Employ bottom-up, analyst-driven research and valuation models to derive relative value within sub-sectors, integrating rigorous financial evaluations into portfolio construction and risk management.

-

Portfolio management and risk assessment

The process involves dynamically shifting capital as valuations evolve, optimising portfolio weightings by trimming or building positions, and employing risk management across security, sub-sector, and geography, including tactical currency risk management.

A trusted team of specialists

Matthew Pace

- Executive Vice President, Cohen & Steers

Matthew Pace

- Executive Vice President, Cohen & Steers

Matthew Pace is head of global relationship management. Prior to joining the firm in 2007, he was a principal at State Street Global Advisors and a member of the Tuckerman Group, State Street Global Advisors real estate investment management firm. Previously, Mr. Pace was a principal in State Street Global Advisors Global Structured Products Group. Mr. Pace has two BA degrees from Hobart College.

Ben Morton

- Executive Vice President, Cohen & Steers

Ben Morton

- Executive Vice President, Cohen & Steers

Benjamin Morton is head of global infrastructure and a senior portfolio manager for Cohen & Steers' infrastructure portfolios. He began working in infrastructure-related investments in 2000. Prior to joining Cohen & Steers in 2003, Mr. Morton worked at Salomon Smith Barney as a research associate for three years, covering the utility and pipelines sectors. He also worked at the New York Mercantile Exchange as a research analyst covering energy commodities. Upon completing graduate school with a focus on environmental economics and policy, Mr. Morton began his career as an intermediary in the emissions trading market. He holds a BA from the University of Rochester and an MES from Yale University.

Cohen & Steers Resources

Unleash in ways you never thought possible

Get in touch

For technical enquiries contact us

8:30am – 6pm AEST Monday to Friday.

Adviser use only

Colonial First State Investments Limited ABN 98 002 348 352, AFSL 232468 (CFSIL) is the responsible entity and issuer of Cohen and Steers Global Listed Infrastructure Fund. Information on this webpage is provided by CFSIL. It may include general advice but does not consider anyone’s individual objectives, financial situation, needs or tax circumstances. You should read the relevant Product Disclosure Statements (PDSs), Information Memorandum (IM) and Financial Services Guides (FSG) before making any recommendations to a client. The PDSs, IM and FSG can be obtained from www.cfs.com.auor by calling us on 13 18 36.