Suggested Search

December 2024

The Government has released the Mid-Year Economic and Fiscal Outlook (MYEFO) for 2024–25.

The mid-year update restated a number of previously announced measures, including:

- 5 year window to commute legacy pensions

- Introduction of payday super from 1 July 2026

- Reforms to the retirement phase of super

The Assistant Treasurer, Stephen Jones issued a media release on 14 December 2024 titled ‘A pathway out of legacy retirement products’.

Regarding the social security treatment of legacy pension commutations, the media release states:

“… social security treatment will not be preserved for those who choose to transition out of their legacy retirement product. However, no debts will arise from the re‑assessment of these products’ asset values for the period before conversion.

Individuals who want to exit their legacy retirement product should consider seeking financial advice before taking action.”

The Government has finalised regulations which relax commutation restrictions on legacy lifetime, life expectancy and market-linked income streams.

Part 1 covers commutation of legacy income streams - the relaxation of commutation restrictions on legacy products allows them to be exited and the resulting capital used to commence another retirement income stream, left in an accumulation account, or withdrawn from superannuation entirely. The commutation must occur within a 5-year window (beginning 7 December 2024).

Part 2 covers allocations from reserves - it provides more flexible pathways to make allocations from a reserve, by:

- Providing several situations in which allocations from reserves supporting an income stream are exempt from counting towards contributions caps. This includes where a reserve supported an income stream that is ceased or commuted, and the reserve is allocated to the former recipient of that income stream.

- Allowing other reserve allocations that would have previously counted towards a member’s concessional contributions cap, to count towards their non-concessional contributions cap, if the allocation is made after the commencement of the regulations.

It's important to note that the Regulations do not cover the social security implications of commuting a legacy income stream - it is unknown at this stage whether further legislation will be released.

FirstTech will provide a Strategic Update on this topic early in the new year.

The bill implementing changes to the annual indexation for study and training loans has received Royal Assent.

Indexation is now based on either the Consumer Price Index (CPI) or Wage Price Index (WPI) – whichever is lower, with effect from 1 June 2023. This means the indexation rate applied on 1 June 2023 of 7.1% will be reduced to 3.2%, and the indexation rate applied on 1 June 2024 of 4.7% will be reduced to 4%.

The ATO will automatically make adjustments and provide the indexation credit to individuals, which will reduce their outstanding loan amount, or result in a refund for the excess amount on debts that are completely repaid after the application of 2023 or 2024 indexation.

How much people with a HELP debt will benefit can be estimated using the HELP Indexation Credit Estimator here.

More information can be found in this FAQ.

November 2024

The Superannuation (Objective) Bill 2024 passed Parliament on 28/11/2024 and awaits Royal Assent.

The new legislation enshrines the objective of superannuation in legislation, requiring policy makers to assess future changes to superannuation legislation for compatibility with this objective.

The objective of superannuation is to preserve savings to deliver income for a dignified retirement, alongside government support, in an equitable and sustainable way (the objective).

The Aged Care Bill 2024 passed Parliament on 25/11/2024 and awaits Royal Assent.

The new legislation includes major changes to both Home Care and Residential Aged Care including fees and charges.

The legislation implements various recommendations made by the Royal Commission into Aged Care Quality and Safety, and is aimed at improving the quality and viability of the aged care system.

Most proposed reforms commence 1 July 2025. Grandfathering applies to existing Residential Aged Care residents and Home Care participants.

Some details of the new reforms are still unknown as they are contained in subordinate legislation known as the 'Rules' which have only been partially released for consultation.

See media release by the Minister for Aged Care, Anika Wells

The Treasurer has issued a media release titled Improving the retirement phase of superannuation which announces reforms to the retirement phase of superannuation.

The reforms will focus on four critical areas to strengthen retirement outcomes:

|

The Government has registered a legislative instrument to increase the maximum amount of accommodation payment that an aged care provider can charge without approval from the Independent Health and Aged Care Pricing Authority (Pricing Authority).

The Aged Care (Subsidy, Fees and Payments) Amendment (Maximum Accommodation Payment) Determination 2024 increases the maximum amount of accommodation payment that can be charged without approval from the Pricing Authority from $550,000 to $750,000 from 1 January 2025. |

September 2024

The ATO have released Tax Determination TD 2024/7 Income tax: deductions for financial advice fees paid by individuals who are not carrying on an investment business.

This Determination sets out when an individual may be entitled to a deduction under sections 8-1 or 25-5 of the Income Tax Assessment Act 1997 for fees paid for financial advice.

The Determination replaces TD 95/60 (now withdrawn) which outlined the ATO’s view on the deductibility of fees paid by a taxpayer to an investment adviser for drawing up an investment plan, and the ongoing management of the investments.

The ATO has stated that the new Tax Determination TD 2024/7 was implemented as a result of regulatory reforms to the financial services industry, however it does not represent a change in the ATO’s view on the deductibility of financial advice fees.

The Paid Parental Leave Amendment (Adding Superannuation for a More Secure Retirement) Bill 2024 has passed both houses and awaits royal assent.

The legislation provides a superannuation contribution for people receiving Parental Leave Pay (PLP) in respect of children born on or after 1 July 2025.

Under the legislation, the ATO will pay the super contribution which is treated as a concessional contribution when received by the person’s super fund. The amount of the super contribution is the sum of all PLP payments during the financial year multiplied by the superannuation guarantee charge percentage (12% from 1 July 2025). The contribution will also include an additional interest component to compensate for forgone returns resulting from the annual payment.

Treasury have released a fact sheet providing more detail on the proposal requiring employers to pay their employees' superannuation guarantee contributions on every pay cycle from 1 July 2026.

The fact sheet provides a number of proposed changes including:

- A new 7 calendar day ‘due date’ from the employee’s payday for super guarantee contributions

- - Changes to the SG charge to create an incentive for employers to address unpaid super quickly

- - Changes to SuperStream data and payment standards to allow payments via the New Payments Platform

- - The ATO Small Business Clearing House will be retired from 1 July 2026

Treasury has released draft regulations which propose to relax commutation restrictions for up to 5 years for specified legacy retirement products including lifetime, life expectancy and market-linked superannuation income stream products. These products either commenced prior to 20 Sept 2007 or were commenced due to the conversion of an earlier legacy product.

The draft regulations also allow for more flexible pathways to make allocations from a reserve, by:

– providing that where a reserve supported an income stream that is ceased, and the reserve is allocated to the former recipient of that income stream, it will be exempt from both contribution caps

– counting other reserve allocations towards an individual’s non-concessional contributions instead of their concessional contributions. |

|

Aged care rates and thresholds for 20 Sept 2024 to 31 Dec 2024 have been released.

For a summary, see the updated FirstTech Quick Reference Guide

The Government introduced new Aged Care legislation to Parliament on 12/9/24. The new legislation includes major changes to both Home Care and Residential Aged Care including fees and charges.

The new Aged Care Bill 2024 implements various recommendations made by the Royal Commission into Aged Care Quality and Safety, and replaces the existing Aged Care Act 1997.

Most proposed reforms commence 1 July 2025. Grandfathering applies to existing Residential Aged Care residents and Home Care participants.

The Government has stated that the new reforms have bipartisan support however it is draft legislation which has not passed as yet.

Key announcements

As the legislation has just been released we have only key announcements at this stage including:

Residential Aged Care - Accommodation Reform

|

| ||||||||||||||||||||

| ||||||||||||||||||||

| ||||||||||||||||||||

|

| ||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||

|

Centrelink have released the rates and thresholds that apply from 20 Sept to 31 Dec 2024.

For a summary, see the updated FirstTech Quick Reference Guide

August 2024

Legislation has been introduced to Parliament to pay a superannuation contribution for people eligible for the Commonwealth-funded Paid Parental Leave (PPL) scheme for births and adoptions on or after 1 July 2025.

Under the proposed legislation, the ATO will pay the super contribution which is treated as a concessional contribution when received by the persons super fund. The amount of the super contribution is the sum of all PPL payments during the financial year multiplied by the superannuation guarantee charge percentage (12% from 1 July 2025).

The contribution will include an additional interest component to compensate for forgone returns resulting from the annual payment.

We've improved the way you access the FirstTech Pocket Guide (mobile version).

Rather than having to download the FirstTech app which required periodic updates, now you can just add a bookmark to your mobile phone or tablet.

The bookmark provides access to the FirstTech Pocket Guide and Age Pension calculator, with the same look and feel as the FirstTech app, but without having to make regular updates.

Note: If you already have the FirstTech app, you will need to delete it and replace it with the bookmark.

How to add bookmark

Simply open this webpage on your mobile phone or tablet

www.cfs.com.au/firsttech/campaigns/firsttech-app.html and follow the instructions to download the bookmark on your iSO (Apple) or Android device.

July 2024

Following the release of the June quarter 2024 CPI figure of 138.8, it appears likely that the general transfer balance cap (TBC) is likely to rise from $1.9 million to $2 million from 1 July 2025.

While indexation of the general TBC is based on December quarter figures, the increase in the June quarter was high enough now to increase the TBC on 1 July 2025, unless deflation occurs.

The December CPI figure would need to reduce back down to 137.4 for the general TBC not to increase to $2 million on 1 July 2025. This would be the equivalent to a negative inflation rate of 1.01 per cent on the six months from the June to December quarter.

You can order printed copies of the following FirstTech Guides:

- FirstTech Super and Retirement Income Streams Guide

- FirstTech Pocket Guide

You can now pre-order free copies for delivery in August.

- Go to: cfs-first-tech.qponline.com.au

- Log in using your User Name and Password if you already have these details, otherwise select 'New User' under the blue 'Log In' button

- Complete the online ordering process

FirstTech has been contacted by a number of advisers asking about the announcement of a $750 Centrelink payment. Please be warned this appears to be a scam. The Australian Government has not announced any such payment.

The scam is supported by websites that outline fake eligibility rules and include buttons to "Apply here".

Clients asking about the payment should be informed that it is a scam and be warned against visiting any websites promoting the payment.

In a media release by the Attorney General, it was announced that the Administrative Review Tribunal (ART) will commence on 14 October 2024.

The ART is a new federal review body that will replace the Administrative Appeals Tribunal (AAT).

The media release states ‘All matters currently before the AAT will continue as usual and will automatically transition to the ART upon its commencement. People who have applied to the AAT for review of a decision do not need to submit a new application, and all AAT decisions that have already been finalised will not be considered again by the ART.’

The ATO has issued Tax Determination TD 2024/5 which outlines the ATO’s views as to how the non-arm's length income (NALI) and capital gains tax (CGT) provisions interact in determining the amount of statutory income that is NALI where a capital gain arises as a result of non-arm's length dealings.

9/7/2024 Social security Budget measures legislated

The Social Services and Other Legislation Amendment (More Support in the Safety Net) Bill 2024 received royal assent on 9 July 2024.

This legislation implements the following measures originally announced in the 2024/25 Federal Budget:

· Increase in the maximum rate of rent assistance by 10% from 20 Sept 2024

· Higher rate of JobSeeker Payment payable to single recipients with a partial capacity to work (less than 15 hours per week) from 20 Sept 2024

· Improved flexibility for Carer Payment recipients, by replacing the 25 hour per week participation limit to 100 hours over 4 weeks. In addition, the participation limit will no longer capture study, volunteering activities and travel time and will only apply to employment. This will apply from 20 March 2025

Regulations have been registered which will prevent Capped Defined Benefit Income Stream (CDBIS) recipients from having their transfer balances negatively impacted by an involuntary rollover to a successor fund.

Previously, where a CDBIS was involuntarily transferred from one superannuation provider to another via a Successor Fund Transfer (SFT), the value of the new income stream would often be different from the value of the old income stream for transfer balance account purposes. Therefore, in such situations, an SFT could have caused an individual’s transfer balance account to increase or decrease.

Under the new regulations, which apply to SFTs that occur on or after 6 July 2024, when an SFT occurs, the transfer balance credit for commencing the new CDBIS must equal to the transfer balance debit from commuting the old CDBIS.

This amendment will also apply retrospectively in instances where a CDBIS recipient was adversely affected by the previous rules (i.e. the CDBIS recipient’s transfer balance account had increased due to an SFT that occurred before 6 July 2024.)

June 2024

The ATO has issued Addendum TR 2013/5A1, updating taxation ruling TR 2013/5 Income Tax: when a superannuation income stream commences and ceases.

Taxation Ruling TR 2013/5 has been updated to:

- include the ATO view on when a superannuation income stream ceases and commences under a successor fund transfer,

- reflect legislative changes, including the transfer balance cap provisions and the concept of retirement phase for superannuation interests,

- the sunsetting on 1 April 2021 of the Income Tax Assessment Regulations 1997 (including removing the requirement for a person to make an election for a payment to be treated as a lump sum commutation in regulation 995-03), and replacement with the Income Tax Assessment (1997 Act) Regulations 2021, and

- contains an appendix on historical legislative changes that have applied in intervening years since the original publication of the ruling in 2013.

The Addendum was issued in draft form in September 2023 and some changes have been made in response to industry feedback.

The ATO has issued for public comment a draft update TR 2023/4DC1, outlining a proposal to consolidate the meaning of “employee” for SG purposes in taxation ruling TR 2023/4.

Taxation Ruling TR 2023/4 explains when an individual is an “employee” for pay-as-you-go withholding purposes.

As a result of the draft update, SGR 2005/1 Superannuation guarantee: who is an employee? was withdrawn on 25 June 2024.

The draft update inserts guidance in Appendix 2 of TR 2023/4, on when a person is an employee under the expanded meaning of the term in s 12(2)-(10) of the Superannuation Guarantee (Administration) Act 1992 (SGAA).

The draft update:

- confirms the ATO’s view in light of case law developments in the context of SGAA since the last update of SGR 2005/1 Superannuation guarantee: who is an employee?

- consolidates the ATO’s view in respect of the common law definition of employee in the withdrawn SGR 2005/1 and TR 2023/4, and

- provides a holistic ATO view of the common law meaning of employee and extended meaning of the word as contained in SGAA.

The proposed date of effect is retrospective and comments on the draft update can be made until 9 August 2024

The Treasury Laws Amendment (Support for Small business and Charities and Other Measures) Bill 2023 has passed both houses of parliament and now awaits royal asset. It contains the following measures:

- Temporary increase to instant asset write-off threshold – For small businesses with an aggregated annual turnover of less than $10 million:

- The instant asset write-off threshold will increase from $1,000 to $20,000 from 1 July 2023 to 30 June 2024. The higher threshold will apply to the cost of eligible depreciating assets, second element costs and general small business pools.

- Extend deferral of the 5 year “lock-out” rule for the small business simplified depreciation rules to 30 June 2024.

- Small business energy incentive – For small and medium businesses with an aggregated annual turnover of less than $50 million:

- A 20% bonus deduction to be made available for eligible expenditure that supports electrification or more efficient energy use, incurred from 1 July 2023 until 30 June 2024.

- The bonus deduction applies to the cost of eligible assets and improvements up to maximum amount of $100,000, with the maximum bonus deduction being $20,000.

- Super fund non-arm’s length expense rules – The following amendments were made to the non-arm’s length income (NALI) provisions that applies to non-arm’s length expenses (NALE) incurred by SMSFs and small APRA funds

- Limit the income of SMSFs and small APRA funds that is taxable as NALI due to a NALE which is a general expense to twice the difference between the amount actually charged and the arm’s length expense amount that would have been charged for a general expense. Note this amendment does not apply to NALE that are specific expenses.

- Fund income taxable as NALI will be limited to taxable income of the fund (not including assessable contributions or deductions against assessable contributions).

- NALE that were incurred or might have been expected to be incurred before the 2018–19 income year are not taken into account when determining whether NALI arises.

Under these changes, large APRA-regulated funds and exempt public sector superannuation funds are exempt from the NALE rules for both specific and general expenses.

The amendments will apply to income derived in the 2018–19 income year or a later income year, and to expenses incurred or expected to have been incurred in the 2018–19 or later income years.

- Expand AFCA powers to hear superannuation related complaints – The Corporations Act 2001 was amended to ensure complaints relating to superannuation that do not meet the definition of a “superannuation complaint” under the legislation may be heard by the Australian Financial Complaints Authority (AFCA). This reverses the effect of the Full Federal Court decision in MetLife v Australian Financial Complaints Authority [2022] FCAFC 173 which led to the AFCA being unable to consider complaints about insurance policies held inside superannuation. This amendment is proposed to apply retrospectively to ensure an individual is not disadvantaged by the Metlife decision.

PCG 2016/5 provides “safe harbour” terms on which SMSF trustees may structure their related party LRBA’s to be consistent with an arm’s length dealing. Those terms include the interest rate the SMSF must pay on related party loans for both real property and listed shares.

The interest rates are based on the Reserve Bank of Australia Indicator Lending Rates for banks and uses the rate for the May before the relevant financial year.

The May 2024 rates have now been issued so the expected safe harbour rates for 2024/25 are:

- Real Property: 9.35%

- Listed Shares or units: 11.35% (the real property rate used plus 2%).

Centrelink have released the rates and thresholds that apply from 1 July 2024 to 19 Sept 2024.

For a summary, see the updated FirstTech Centrelink Quick Reference Guide - 1 July 2024 to 19 Sept 2024.

May 2024

The ATO have issued a reminder to SMSF members claiming a deduction for personal super contributions to ensure they:

- complete and lodge a Notice of Intent to claim or vary a deduction for personal super contributions, and

- receive a written acknowledgement from the fund confirming they have received a valid notice of intent to claim a deduction

prior to claiming the deduction and prior to initiating a rollover or closing their account in the SMSF.

Members should also ensure the notice of intent is lodged and acknowledged by the SMSF before commencing an income stream in the SMSF.

The House of Reps has, for the second time, voted against proposed Senate amendments to the Treasury Laws Amendment (Support for Small Business and Charities and Other Measures) Bill 2023. The Bill will go back to the Senate which is not due to sit again until 24 June 2024. As a result, the measures in the Bill remain in limbo including the 2023 Federal Budget proposal to amend the Non-Arm’s Length Expense (NALE) rules for general expenses incurred by SMSFs and Small APRA funds.

Under the current law, where a SMSF or Small APRA fund incurs a non-arm’s length general expense, all income derived in the fund can be considered Non-Arm’s Length Income (NALI) and taxed at the highest marginal rate. The Bill amends the NALI rules from the 2018–19 year for SMSFs and Small APRA funds to limit the amount of income that will be taxed as NALI where a fund incurs a non-arm’s length general expense to 2 times the level of the expenditure breach, calculated as the difference between the amount that would have been charged to the fund as an arm’s length expense and the amount that was actually charged.

The Bill also ensures that expenses incurred or expected to have been incurred before 1 July 2018 cannot result in the application of the NALE rules.

The ATO’s compliance approach outlined in PCG 2020/5 to not allocate compliance resources to determine whether NALI applies where non-arm’s length general expenses were incurred applied up to 30 June 2023 and at the time of writing has not been extended beyond then, leaving SMSFs and Small APRA funds uncertain on how non-arm’s length general expenses will be treated from 1 July 2023.

The Social Services and Other Legislation Amendment (Military Invalidity Payments Means Testing) Bill 2024 passed both houses and awaits royal assent.

The purpose of the Bill is to confirm the assessment of certain military invalidity pensions affected by Douglas case (Commissioner of Taxation v Douglas [2020]).

The decision in Douglas found that certain military invalidity benefits paid under the Military Superannuation and Benefits Scheme and the Defence Force Retirement and Death Benefits Scheme (MSB, DFRDB, the affected payments) that commenced on or after 20 September 2007 should be taxed as “superannuation lump sums” rather than “superannuation income streams”. Prior to Douglas, the affected payments were taken to be superannuation income streams for tax purposes.

The affected payments have previously been treated as “asset-test exempt income streams” and “defined benefit income streams” under the Social Security Act and the Veterans’ Entitlements Act. However, the Douglas decision also found the affected payments may not be “taken to be a pension” for the purposes of the SIS Act 1994 and therefore could not be defined as a “defined benefit income stream”.

The new provisions are designed to produce the same assessment of income as the historical assessments of the affected invalidity payments, and to ensure the invalidity payments continue to be treated as exempt from the assets test. These arrangements are intended to ensure veterans and/or their partners receive a level of support that is consistent with the intent of legislation and policy before the unexpected findings of the Douglas decision.

The Senate Economics Legislation Committee has recommended that legislation implementing a new Division 296 tax be passed.

The Committee “strongly supports the reforms to superannuation tax concessions that will ensure they are fairer, more sustainable, and better targeted.”

The new Division 296 tax will impose a tax rate of 15% on superannuation "earnings" corresponding to superannuation balances that exceed $3m for an income year commencing 1 July 2025.

The Government handed down the Federal Budget on 14 May 2024.

Labor’s third Budget was widely expected to focus on cost of living. This was delivered in the form of energy bill relief for all households, along with Stage three tax cuts that had already been legislated.

Social security proposals included freezing deeming rates at their current levels for a further 12 months, increases to Commonwealth Rent Assistance, and more flexibility for Carer Payment recipients.

Super was largely left unchanged although the Treasurer announced plans for eligible parents to receive 12 per cent super on of their government-funded Paid Parental Leave. For small businesses, the government announced it would extend the $20,000 small business instant asset write-off by 12 months until 30 June 2025.

For a detailed summary see the FirstTech briefing paper. Additional resources such as client information flyers are available on the Firsttech Federal Budget page.

The Government has issued a media release announcing a change to the way HELP/HECS debts are to be indexed, with effect from 1 June 2023.

The HELP indexation rate will be capped to the lower of either CPI or the Wage Price Index (WPI).

The Government has stated that backdating the indexation method to all HELP, VET Student Loans, Australian Apprenticeship Support Loans and other student loan accounts that existed on 1 June last year wipes off around $3 billion in student debt. Under the current indexation method, student loans would have been indexed by 7.1% last year, whereas the new indexation method using WPI would only be 3.2%.

An individual with an average HELP debt of $26,500 will see around $1,200 wiped from their outstanding HELP loans this year once the legislation is passed.

Australians with a HELP debt can find out how much this is estimate to benefit them using the HELP Indexation Credit Estimator here.

ASIC have commenced a review of superannuation industry practices and compliance with laws in relation to the administration of death benefit claims.

ASIC has released guidance from the first phase of the review, which 'revealed areas for improvement in trustees’ public communications'.

April 2024

Division 7A of the Income Tax Assessment Act 1936 can apply to loans, payments or other benefits when a shareholder or their associate accesses money from their private company. When not managed correctly, this can result in the transfer of funds out of private companies being treated as an unfranked dividend with larger than expected tax outcomes.

To avoid these outcomes, payments and outstanding loans can be placed on a complying Division 7A loan.

In a series of articles and webinars titled “Decoding Division 7A”, the ATO aim to highlight the rules around complying Division 7A loans, the common mistakes that are made and how to avoid them. Articles issued so far are:

The articles link to the ATO’s detailed content on private company benefits – Division 7A dividends.

The ATO advises that they will continue to provide more information aimed at helping understand Division 7A and avoiding mistakes over the coming months. The next article will focus on the rules for minimum yearly repayments on complying loans.

The government has issued draft regulations that will amend the transfer balance cap provisions to ensure that a member with a capped defined benefit income stream is not adversely impacted if they move to a new fund under a successor fund transfer.

Under current legislation, a member’s transfer balance may be unintentionally impacted due to the original income stream ceasing and a new one beginning.

The draft legislation would amend the transfer balance credit provisions so that the credit and debit arising due to a successor fund transfer for individuals with a capped defined benefit income stream are equal. This would ensure the amounts cancel each other out and the member’s transfer balance account is not impacted by the successor fund transfer.

The amendments would apply to successor fund transfers occurring from the day after registration of the regulations, but would also apply retrospectively to successor fund transfers from 1 July 2017 where the member was disadvantaged by the current rules.

The Minister for Aged Care has issued a media release regarding a delay in the commencement date of the new Aged Care Act which was proposed to commence on 1 July 2024.

In the media release, the Minister states ‘The Government is now considering the extensive and valuable feedback to refine and finalise the draft legislation before it is introduced to Parliament.

We will update the commencement date of the legislation following these updates and before the bill is introduced to the Parliament.’

While the new commencement date is yet to be announced, there is speculation it may be 1 July 2025.

The government has issued a commencement proclamation for changes to the First Home Super Saver (FHSS) scheme.

The changes to the FHSS scheme are aimed at improving access to the scheme and received royal assent on 20 Sept 2023, see Treasury Laws Amendment (2023 Measures No. 3) Act 2023, Schedule 4.

The commencement date of these reforms has now been confirmed as 15 Sept 2024.

For more information on the reforms, see the FirstTech article FHSS scheme flexibility Changes pass parliament, yet to commence

March 2024

FirstTech quick references guides are now available updated for 20 March 2024:

This FirstTech quick references guide sets out the super rates and thresholds for 2024/25.

The Government has released draft regulations Treasury Laws Amendment (Measures for Future Instruments) Instrument 2023: Better Targeted Superannuation Concessions to support implementation of the calculation of Division 296 tax for defined benefit interests.

This includes:

- outlining methods to value defined benefit interests

- making modifications to the Division 296 earnings formula to appropriately capture notional contributions to defined benefit interests.

- updating existing methods to calculate notional contributions for defined benefit interests to reflect up-to-date economic parameters. The government stated, “these methods have not been updated for many years and do not reflect the correct social and economic climate”.

The Government welcomes feedback from all interested parties, with submissions open until 26 April 2024.

In a media release, the Government has announced the release of the final report from the Aged Care Taskforce.

Chaired by the Minister for Aged Care Anika Wells, the Aged Care Taskforce brought together representatives of older Australians, aged care providers, and experts, to consider the great unanswered question of the Royal Commission: how to sustainably fund aged care into the future.

The Taskforce Report delivers 23 recommendations to improve the sustainability of aged care.

The Government will be considering the recommendations of the report and is expected to advise their policy position prior to the Federal Budget.

The Government has released a consultation paper seeking input to improve the annual superannuation performance test.

The Government is seeking feedback on the following four options to fine-tune and improve the sophistication of the performance test in the longer term, should the government decide to do so in the future:

- Status quo – retain the current testing framework but improve it.

- Alternative single-metric – consideration of a different single-metric framework that would better assess performance. Three specific examples included are the Sharpe ratio, a peer comparison, and a simple-reference portfolio frontier.

- Multi-metric framework – consideration of a multiple metric framework that provides a more fulsome assessment of performance. Two specific examples included are a framework that aligns with the APRA heatmaps, and a targeted three-metric test.

- Alternative framework – an opportunity for stakeholders to put forward an option they see as most fitting to improve the operation of the performance test.

All interested parties are encouraged to provide input, with submissions open until 19 April 2024.

The Minister for Social Services, Amanda Rishworth has issued a media release today announcing the Government will pay superannuation on Paid Parental Leave (PPL) from 1 July 2025.

The media release states that “this reform is an investment in women’s economic security and in the broader economy” and was also a key recommendation of the Women’s Economic Equality Taskforce.

It is expected eligible parents with babies born or adopted after 1 July 2025 will receive an additional 12% on their PPL paid into their super account.

This announcement builds on the Government’s measures to modernise and expand the PPL scheme, which was first announced as part of the October 2022-23 Budget.

The first tranche of changes to the PPL scheme commenced in July 2023, including an increase of the PPL family income test to $350,000 and making it easier for both parents to share care.

Implementing the second tranche of changes, the Paid Parental Leave Amendment (More Support if Working Families) Bill 2023 is currently before the Senate. If legislated, PPL payments will be extended by 2 weeks each year from 1 July 2024 to reach 26 weeks from 1 July 2026.

February 2024

Legislation implementing the Government's changes to the Stage 3 tax cuts has passed both houses of parliament without amendment and awaits royal assent.

The Treasury Laws Amendment (Cost of Living Tax Cuts) Bill 2024, will give effect to the following changes to marginal tax rates from 1 July 2024:

- reduce the current 19% tax rate to 16%

- reduce the current 32.5% tax rate to 30%

- increase the current threshold above which the 37% tax rate applies from $120,000 to $135,000

- increase the current threshold above which the 45% tax rate applies from $180,000 to $190,000

The Treasury Laws Amendment (Cost of Living - Medicare Levy) Bill 2024 increases the Medicare levy low income thresholds from 2023/24. For example, the threshold for single taxpayers (not eligible for SAPTO) increases from $24,276 to $26,000.

For more information see the FirstTech article Changes to stage 3 tax cuts pass parliament - advice implications

Following today’s release of the latest average wages data for the December 2023 quarter, the concessional and non-concessional contribution caps will increase on 1 July 2024 as follows:

- Concessional contributions cap $30,000

- Non-concessional contributions cap $120,000

The increase in the annual non-concessional contributions (NCCs) cap also means a person’s NCC cap under the bring forward rules will increase to a maximum of $360,000 from 1 July 2024.

For further information including advice implications and the impact on other thresholds, see this FirstTech NewsFlash.

The Government has announced a new social security agreement has commenced between Australia and the Republic of Serbia on 1 February 2024, improving access to retirement benefits for eligible people who have moved between the two countries.

Under the agreement:

- Former Australian residents living in Serbia can claim the Australian Age Pension without having to return to Australia to live, and former Serbian residents living in Australia will have better access to Serbian retirement pensions.

- People can combine periods of residence in Australia with periods of insurance contributions in Serbia to satisfy the minimum requirements for an Australian or Serbian pension, meaning they can access their pension sooner.

- Employers of workers temporarily seconded between Australia and Serbia no longer have to pay both compulsory superannuation contributions in Australia and insurance contributions in Serbia, removing the onus of double payments.

Minister for Social Services Amanda Rishworth and Foreign Minister Penny Wong said the new agreement will be welcomed by citizens of both Australia and Serbia and will further strengthen the relationship between the two countries.

In its first three years, the agreement is expected to result in around 1,000 additional people living in Australia and Serbia being able to access the Australian Age Pension.

January 2024

Following the release today of the December 2023 quarter CPI figure, it is expected that the general transfer balance cap (TBC) will remain at $1.9 million for 2024-25.

The general TBC is indexed in line with increases in CPI but only increases in $100,000 increments. The Dec 2023 quarter CPI figure of 136.1 was not high enough to trigger an increase in 2024-25.

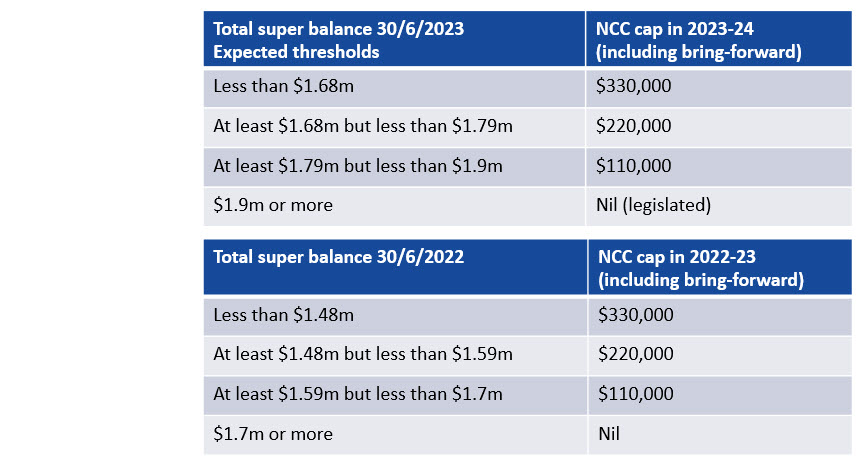

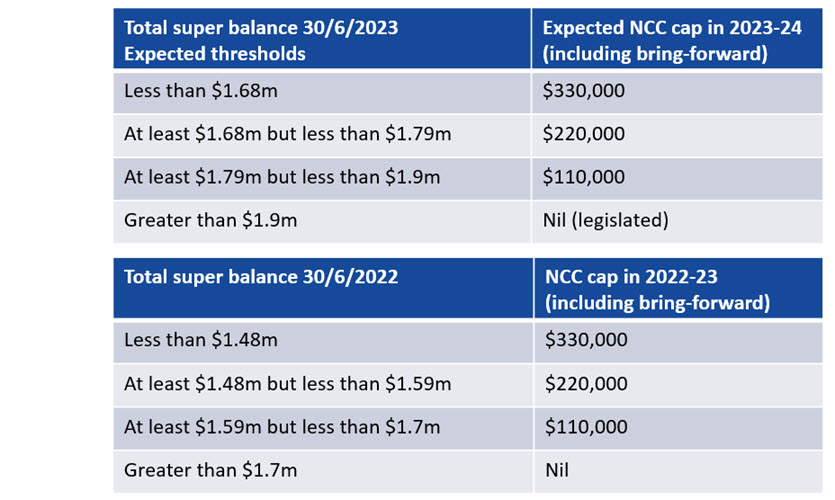

Likely impact on non-concessional cap thresholds

Eligibility to make non-concessional contributions (NCC) is based on a client's total super balance (TSB) on 30 June of the previous financial year. As the general TBC is expected to remain at $1.9 million in 2024-25, a client will be able to make a standard NCC if TSB is below $1.9 million at 30 June 2024.

However, the ability to make NCC under the bring forward rule is also impacted by the standard NCC cap. As both the concessional and non-concessional caps are expected to increase in 2024-25 to $30,000 and $120,000 respectively, this will likely impact total super balance thresholds.

Strangely, if the standard NCC threshold increases to $120,000, it will cause the TSB thresholds for the NCC bring forward rule to reduce as the thresholds are calculated by subtracting the NCC cap from the general transfer balance cap. This is demonstrated in the following tables:

Total super balance thresholds for NCC - 2023/24

TSB at 30 June 2023 | NCC cap including bring-forward rule |

Less than $1.68m | 3 year bring-forward period ($330,000 cap) |

$1.68m to less than $1.79m | 2 year bring-forward period ($220,000 cap) |

$1.79m to less than $1.9m | No bring-forward (standard $110,000 cap applies) |

$1.9m or more | Non-concessional cap is Nil |

Total super balance thresholds for NCC - 2024/25

Assuming the standard non-concessional cap increases to $120,000

TSB at 30 June 2024 | NCC cap including bring-forward rule |

Less than $1.66m | 3 year bring-forward period ($360,000 cap) |

$1.66m to less than $1.78m | 2 year bring-forward period ($240,000 cap) |

$1.78m to less than $1.9m | No bring-forward (standard $120,000 cap applies) |

$1.9m or more | Non-concessional cap is Nil |

As the NCC cap is indexed to AWOTE, and the NCC cap is 4 x the concessional cap, we need to wait for the Dec quarter AWOTE figure to be released in late February 2024 to confirm. However, clients considering triggering either a two or three year bring-forward period in 2024-25 may need to be aware of the lower TSB thresholds that may apply.

The Government has proposed changes to the already legislated stage 3 tax cuts commencing on 1 July 2024.

In a media release, the Government stated that these changes are “designed to provide bigger tax cuts for middle Australia to help with cost-of-living, while making our tax system fairer.”

The proposed changes, effective from 1 July 2024 if legislated, will:

- reduce the current 19% tax rate to 16%

- reduce the current 32.5% tax rate to 30%

- increase the current threshold above which the 37% tax rate applies from $120,000 to $135,000

- increase the current threshold above which the 45% tax rate applies from $180,000 to $190,000

For more information on the proposed changes including advice implications, see the FirstTech Newsflash Proposed changes to the stage 3 tax cuts.

December 2023

On 14 December 2023, the Department of Health & Aged Care released an exposure draft of the new Aged Care Bill 2023 for public consultation. Members of the public and interested organisations can provide their feedback, with submissions open until 16 February 2024.

The exposure draft includes the parts of the Bill that incorporate the most significant changes in response to the Royal Commission into Aged Care Quality and Safety.

The new Act aims to improve the ways services are delivered to older people in:

- their homes

- community settings

- approved residential aged care homes.

It will:

- outline the rights of older people who are seeking and accessing aged care services

- create a single-entry point, with clear eligibility requirements to make access to the aged care system for older people easier

- include a fair, culturally safe single assessment framework

- support the delivery of aged care services

- establish new system oversight and accountability arrangements

- increase provider accountability through a new regulatory model

- strengthen the powers of the regulator, the Aged Care Quality and Safety Commission, to manage risk, ensure integrity and support aged care.

It is expected that the new Aged Care Act will include changes to funding arrangements including means testing. Chapter 4 of the exposure draft which deals with ‘Fees, Payments and Subsidies’ is not yet available. The Government has established The Aged Care Taskforce (Taskforce) to ‘review funding arrangements for aged care and develop options for a system that is fair and equitable for everyone in Australia’. It is expected that the final report and the Government's response will be available end of January 2024.

Subject to being passed in Parliament, the new Act is planned to start on 1 July 2024. It will replace existing legislation, including the current Aged Care Act and the Aged Care Quality and Safety Commission Act 2018.

The Government has released the Mid-Year Economic and Fiscal Outlook (MYEFO) for 2023–24.

This release includes a number of proposed changes to superannuation and tax law, including:

- Providing a clear legal basis for superannuation trustees to pay advice fees agreed between a member and their financial adviser from the member’s superannuation account and prescribe that such fees are a tax-deductible expense of the fund retrospectively from 2019–20.

- Increasing the foreign resident capital gains withholding tax rate from 12.5% to 15% and reducing the withholding threshold from $750,000 to $0 (this would apply to real property disposals with contracts entered into from 1 January 2025).

- Amending legislation to ensure the superannuation transfer balance cap of individuals with capped defined benefit income streams are not adversely impacted in the event of a merger or successor fund transfer between superannuation funds.

- Denying tax-deductions for the general interest charge (GIC) and shortfall interest charge (SIC) incurred in income years starting on or after 1 July 2025.

The ATO has released Draft Tax Determination TD 2023/D4 Income tax: deductions for financial advice fees paid by individuals who are not carrying on a business.

This draft Taxation Determination is being published to assist in confirming the requirements that need to be satisfied for an individual who is not carrying on a business to be eligible to claim a deduction for financial advice fees.

The Draft Taxation Determination will replace TD 95/60 released in 1995. The draft Taxation Determination does not change the view expressed in TD 95/60. However, it does include new content on the deductibility of financial advice fees as tax-related expenses under section 25-5 of the Income Tax Assessment Act 1997.

The Government has released a discussion paper seeking input on policy and regulatory changes to improve the outcomes for superannuation fund members in retirement.

The paper identifies that Australians need better access to information, advice, and well-rounded retirement income products to help them navigate these challenges in retirement.

The paper focuses on three key areas:

- Supporting members to navigate the retirement income system,

- Supporting funds to deliver better retirement income products and services, and

- Making lifetime income products more accessible.

The Government welcomes views from all interested parties, with submissions open until 9 February 2024.

November 2023

The Treasury Laws Amendment (Better Targeted Superannuation Concessions) Bill 2023 and Superannuation (Better Targeted Superannuation Concessions) Imposition Bill 2023 have been introduced to the House of Representatives on 30 November 2023.

For each income year from 2025-26, the Commissioner of Taxation will calculate a Division 296 tax liability and notify individuals of their tax liability for a given income year.

Division 296 tax will be levied at a rate of 15 per cent on a percentage of the individual’s superannuation earnings equal to the percentage of their TSB above $3 million.

This adjustment will apply prospectively and does not impose a limit on the size of superannuation account balances.

The Bill is currently before the House of Representatives and is subject to potential amendments before it passes both houses.

The Social Security and Other Legislation Amendment (Supporting the Transition to Work) Bill 2023 passed both houses of parliament and received royal assent on 28 November 2023.

Under the new legislation:

- From 1 January 2024 , the temporary enhancements to the Work Bonus that were scheduled to end on 31 December 2023 will be made permanent. Under the permanent enhancements, new pension entrants over Age Pension age and eligible Veterans will have a starting Work Bonus income bank balance of $4,000, and pensioners will retain the current elevated maximum Work Bonus balance limit of $11,800 rather than $7,800.

The Bill also includes provisions to allow eligible Work Bonus recipients on or after 1 July 2024 to receive a ‘top-up’ to their Income Bank to a maximum of $4,000 once every two years in limited circumstances.

- From 1 July 2024, the employment income nil rate period will be doubled from 12 weeks to 24 weeks, to reduce barriers for income support recipients to take up work by allowing them to retain concession cards and other supplementary benefits for a longer period. This change will apply to recipients of JobSeeker, Youth Allowance, Austudy, ABSTUDY, Parenting Payment, Age Pension, Disability Support Pension and Carer Payment.

To combat against rising levels of identity fraud in Australia, the Government has announced new fraud controls aimed at making it safer for Australians to protect and access their myGov information.

The Minister states that from now on, individuals who use their myGovID to login to their ATO account will need to use that myGovID for future logins. It will not be possible to access an ATO account without it (eg via an email/username and password).

These measures are aimed at countering illicit access of ATO accounts by people using stolen personal information obtained from the dark web.

The Government has introduced the Superannuation (Objective) Bill 2023 which will enshrine the objective of superannuation in legislation, requiring policy-makers to demonstrate how any future changes to superannuation law are consistent with the legislated objective.

The objective is "to preserve savings to deliver income for a dignified retirement, alongside government support, in an equitable and sustainable way".

The draft legislation has not yet passed parliament.

The FirstTech Social Security Guide and the FirstTech Aged Care Guide have been updated for legislative changes, rates and thresholds as at 20 September 2023.

From late October 2023, Services Australia will review residential aged care and home care fees on a monthly basis. Previously it was reviewed quarterly.

The monthly reviews will apply changes to care recipient fees closer to when changes happen. The reviews will also calculate any applicable refund amounts as part of the next monthly claim process.

This means care recipients may receive more regular letters advising of fee changes or refunds.

For more information see Important update: More regular reviews of aged care fees

October 2023

The Minister for Financial Services, Stephen Jones has issued a media release announcing the Government’s intention to amend the transfer balance cap legislation.

The proposed changes are aimed at ensuring that members with a capped defined benefit income stream are not adversely impacted by a merger or successor fund transfer between superannuation funds.

Under current legislation, a member’s transfer balance cap may be unintentionally impacted due to the original income stream being treated as ceasing and a new one beginning.

This means a new valuation of the capped defined benefit income stream is required which can result in a higher valuation for the transfer balance cap and lead to adverse outcomes for some members.

The media release states the ‘Government will ensure that members receiving an income stream prior to a merger or successor fund transfer will continue to receive their income stream without unintentionally impacting the transfer balance cap.’

The amendments are proposed to apply retrospectively from 1 July 2017.

Last month, the government announced several changes to the social security Work Bonus and Employment income nil rate period.

The Social Security and Other Legislation Amendment (Supporting the Transition to Work) Bill 2023 has been introduced today to implement these changes.

Under the proposed legislation:

• From 1 January 2024 , the temporary enhancements to the Work Bonus that were scheduled to end on 31 December 2023 will be made permanent. Under the permanent enhancements, new pension entrants over Age Pension age and eligible Veterans will have a starting Work Bonus income bank balance of $4,000, and pensioners will retain the current elevated maximum Work Bonus balance limit of $11,800 rather than $7,800.

The Bill also includes provisions to allow eligible Work Bonus recipients on or after 1 July 2024 to receive a ‘top-up’ to their Income Bank to a maximum of $4,000 once every two years in limited circumstances.

• From 1 July 2024, the employment income nil rate period will be doubled from 12 weeks to 24 weeks, to reduce barriers for income support recipients to take up work by allowing them to retain concession cards and other supplementary benefits for a longer period. This change will apply to recipients of JobSeeker, Youth Allowance, Austudy, ABSTUDY, Parenting Payment, Age Pension, Disability Support Pension and Carer Payment.

The government released a consultation paper on the framework to pay superannuation guarantee (SG) at the same time as salary and wages. This initiative was part of the Securing Australians’ Superannuation package, which was originally announced at the 2023-24 Federal Budget.

The payday super initiative aims to strengthen Australia’s superannuation system by making improvements and changes in different areas, including:

• Increasing the payment frequency of the SG

• Investing in SG compliance, and

• Improving SG recovery measures

The consultation paper is seeking input from industry and stakeholders on the policy and legislative design of the Securing Australians’ Superannuation package. Consultation closes on 3 November 2023.

For further information see the Treasurer’s media release here.

Further to an announcement by the Treasurer in February 2023, Treasury has released draft legislation regarding the Government’s proposal to apply an additional 15% tax on superannuation earnings corresponding to a client’s total superannuation balance over $3 million from 2025–26 (Division 296 tax).

The Bill largely reflects the initial proposal regarding how this tax will be calculated and levied:

• A member’s superannuation earnings for a financial year are generally calculated as their total superannuation balance at the end of the year (adjusted for withdrawals and contributions made during the year) less their total superannuation balance at the end of the previous year (negative earnings can be carried forward to offset future earnings)

• The portion of a member’s superannuation earnings subject to Division 296 tax in a financial year is calculated by multiplying those earnings by the proportion of their total superannuation balance at the end of the year that is above $3 million.

• Division 296 tax is levied on the individual member and due 84 days after a notice of assessment is issued. The member can choose to pay the tax personally or have it released from one or more eligible superannuation interests. Debt deferral arrangements will apply for defined benefit interests.

Members who have ever made structured settlement contributions or who die during the year will not have to pay Division 296 tax for a year.

The Bills also propose to modify the definition of total superannuation balance in a way that removes the link between a member’s transfer balance account and calculation of their total superannuation balance. Regulations will be needed to clarify how some interests will be valued (e.g. defined benefit pensions). This change would apply from immediately before 1 July 2025 and apply for all purposes which total superannuation balance is relevant (e.g. determining non-concessional cap). A member’s total superannuation balance would still be reduced by structured settlement contributions made. Certain LRBA amounts are not included in a member’s total superannuation balance for Division 296 purposes, but will remain included for other purposes.

This draft legislation has not been introduced into Parliament and is not yet law.

September 2023

FirstTech have released the Centrelink rates & thresholds - quick reference guide, effective 20 Sept 2023 to 31 Dec 2023.

FirstTech have also released the Aged Care rates & thresholds - quick reference guide, effective 20 Sept 2023 to 31 Dec 2023.

The ATO has released Draft Tax Ruling TR 2013/5DC1, which proposes changes to TR 2013/5 Income tax: when a superannuation income stream commences and ceases.

The proposed changes reflect legislative amendments, clarify how the general principles in the Ruling apply to successor fund transfers, and remove practical compliance approaches that were related to historical periods and are no longer relevant.

The ATO has released updated PCG 2022/2 which sets out how the ATO assesses risk for a range of trust arrangements to which section 100A of the Income Tax Assessment Act 1936 might apply.

The Guideline provides examples of how the Commissioner will dedicate compliance resources for arrangements that are low risk (green zone) or high risk (red zone).

The updated Guideline includes minor amendments at paragraph 32 to clarify some features of arrangements that are excluded from the green zone.

As part of the release of the Employment White Paper, the Government has announced two key changes for pension and income support recipients.

Pending the passage of legislation:

• From 1 January 2024 , the temporary enhancements to the Work Bonus that were scheduled to end on 31 December 2023 will be made permanent. Under the permanent enhancements, new pension entrants over Age Pension age and eligible Veterans will have a starting Work Bonus income bank balance of $4,000, and pensioners will retain the current elevated maximum Work Bonus balance limit of $11,800 rather than $7,800.

• From 1 July 2024, the employment income nil rate period will be doubled to 12 fortnights (six months) to reduce barriers for income support recipients to take up work by allowing them to retain concession cards and other supplementary benefits for a longer period. This change will apply to recipients of JobSeeker, Youth Allowance, Austudy, ABSTUDY, Parenting Payment, Age Pension, Disability Support Pension and Carer Payment.

Further information can be found in the Treasury media release here.

The ATO has reminded SMSFs that they must report certain events that affect members transfer balance accounts quarterly using transfer balance account reporting (TBAR). These events must be reported even if the member's total superannuation balance is less than $1 million. SMSFs must report and lodge within 28 days after the end of the quarter in which the event occurs. They are not required to lodge if no TBA event occurred during the quarter. SMSFs who were currently lodging the TBAR annually at the same time as the SMSF annual return, will need to report all events that occurred in the 2023 income year by 28 October 2023.

The Social Security Amendment (Australian Government Disaster Recovery Payment) Bill 2023 passed both houses on 14 Sep 2023 and now awaits royal assent.

The bill will amend the Social Security Act 1991 to include an alternative objective qualification criteria to provide greater certainty in supporting automation processes and ensure the timely payment of claims for the Australian Government Disaster Recovery Payment (AGDRP).

The AGDRP is a one-off payment to eligible persons who are adversely affected by a major disaster. More information on the payment can be found on the Social Services website in this link.

The Treasury Laws Amendment (Support for Small Business and Charities and Other Measures) Bill 2023 was introduced in the House of Representatives on 13 Sep 2023. It implements several previously announced measures from the 2023-24 Federal budget, which includes:

• 20K instant asset write-off – to increase the instant asset write-off threshold from $1,000 to $20,000, which is only available to small businesses with an aggregated annual turnover of less than $10 million. It applies to eligible depreciating assets first used or first installed ready for use for a taxable purpose in the period from 1 July 2023 until 30 June 2024.

• Small business energy incentive – to provide small and medium businesses with an aggregated annual turnover of less than $50 million access to a bonus deduction equal to 20% of the cost of eligible assets or improvements to existing assets that support electrification or more efficient energy use. It applies to eligible assets first used or first installed ready for use, and eligible improvement costs incurred, from 1 July 2023 until 30 June 2024.

• Super fund non-arm's length expenses – proposes changes to the rules for non-arm's length expenses (NALE) for superannuation entities as follows:

• Large APRA-regulated funds including exempt public sector superannuation funds would be exempt from the rules related to non-arm's length expenses, although these funds are still subject to rules for income derived on a non-arm's length basis.

• For SMSF and small APRA fund general fund expenses that are NALE, the amount of non-arm’s length income would be calculated as twice the difference between the amount that would have been expected to have been incurred had the parties been dealing at arm’s length, and the amount actually incurred, with no deductions applying against that amount. However, the fund’s total non-arm’s length component cannot exceed the fund’s assessable income minus deductions, excluding assessable contributions and deductions against them.

• The Bill does not propose any changes to the treatment of specific expenses (those relating to gaining or producing income from a particular asset or assets of the fund). Previous treatment continues to apply where the amount of income that is taxed as non-arm’s length income is the amount of income derived from the scheme in which the parties were not dealing at arm’s length.

• Expenses incurred or expected to have been incurred before 1 July 2018 cannot result in the application of the NALE rules.

• The amendments will apply in relation to income derived in the 2018-19 income year and following income years.

The Assistant Treasurer, Stephen Jones issued a media release titled ‘Increased flexibility for the First Home Super Saver Scheme’ on 8 Sept 2023.

The media release states the Government had ‘passed legislation addressing significant pain-points in the scheme.’

The Treasury Laws Amendment (2023 Measures No.3) Bill 2023 passed both houses on 6 Sept 2023 and awaits royal assent.

Changes to the scheme schedule:

• Having up to 90 days after entering into a contract to purchase or build a first home, to request the release of contributions and earnings (previously 14 days).

• Allowing users of the scheme to amend or revoke applications made under the scheme (for example release requests).

• Allowing eligible people to use the scheme if they have entered into a contract to purchase their first home but have not yet become the legal owner.

It is important to note that at this stage it is unknown when the changes will commence. The legislation states the changes do not commence until the earlier of date of proclamation and 12 months from date of royal assent. Once the changes commence, many amendments will be backdated to 1 July 2018.

The Minister for Social Services, Amanda Rishworth has issued a media release detailing increases to social security payments from 20 Sept 2023.

The increases are due to indexation, as well as measures originally announced in the Federal Budget and subsequently legislated.

From 20 Sept 2023:

• Single JobSeeker Payment recipients will receive a base payment of $749.20 per fortnight, reflecting a $56.10 increase.

• Parenting Payment Single recipients will receive a base payment rate of $942.40, reflecting a $20.30 increase. For those single parents transferring to this payment as a result of the Government’s change in the Budget to extend eligibility until their youngest child turns 14 (up from aged eight), they will receive an extra $227.50 per fortnight compared to their current rate, including supplements.

• Those on a partnered rate of JobSeeker and Parenting Payment will receive a base payment rate of $686.00, reflecting a $54.80 increase.

• As a result of indexation, recipients of the Age Pension, Disability Support Pension and Carer Payment will also receive an increase to their payments. The single pension rate will increase by $32.70 to $1096.70, and the rate for couples combined will increase by $49.40 to $1653.40.

• Single veterans on a service pension will receive an additional $32.70, bringing their service pension to $1096.70 a fortnight, while veterans on the Disability Compensation Payment (Special Rate), known as the Totally and Permanently Incapacitated Payment will receive an additional $53.00 a fortnight, increasing their payment to $1729.20.

• Income support recipients who are renting will also receive an increase to the maximum rates of Commonwealth Rent Assistance, as a result of both the Government’s 15 per cent increase in the Budget and regular indexation.

• Income limits for Commonwealth Seniors Health Card recipients will also be indexed, increasing by $5400 to $95,400 per annum for singles and by $8640 to $152,640 per annum for couples combined.

• Other supplementary payments including Telephone Allowance and Utilities Allowance are also being indexed.

August 2023

The ATO recently updated their guide on Market valuation for tax purposes.

The guide is intended to assist taxpayers better understand the commissioner’s expectations on market valuation for tax purposes and sets out the basis for an adequate and acceptable valuation approach.

The updates to the guide included two changes:

• remove specific references to institutes that provide certification and standards for valuers, and

• insert general statements on the need for valuers to have the appropriate certification and registration or licensing.

The 2023 Intergenerational Report was released by Treasury on 24 August 2023. The report projects the economic outlook and the Australian Government’s budget to 2062-63. The report identifies 5 major forces which will shape the Australian economy in the coming decades:

This bill implements a number of social security measures announced in the 2023 Federal Budget including:

• population ageing

• technological and digital transformation

• climate change and the net zero transformation

• rising demand for care and support services

• geopolitical risk and fragmentation

Among other findings, the report depicts that the Australian population is anticipated to reach 40.5 million by 2062-63, with a significant increase in the elderly population. This will induce a shift towards a more service-based economy due to an aging population, impacting sectors such as care services.

Regarding government revenue, tax receipts are expected to make up 93.9% of total receipts by 2062-63, with declining revenue from traditional sources such as fuel and tobacco excise. Personal income tax is projected to grow, while company tax declines, potentially leading to an increased personal tax burden.

The report also highlights that health, aged care, NDIS, defence and interest payments on debt will account for a significant portion of Commonwealth spending in 40 years’ time, increasing from currently one third to one-half of the total spend by 2062-63.

The Government has established The Aged Care Taskforce (Taskforce) to ‘review funding arrangements for aged care and develop options for a system that is fair and equitable for everyone in Australia’.

The Taskforce will seek feedback on draft aged care funding principles and will build on the recommendations in the Royal Commission into Aged Care and Safety.

The Aged Care Taskforce Terms of reference include:

• funding and contribution approaches to support innovation in the delivery of care,

• a fair and equitable approach to assessing the means of older people accessing residential and in-home aged care, including the scope of income and assets included in the assessment of means,

• issues and trade-offs for including and excluding different service types in the new in-home aged care program (the service list),

• consumer contributions for in-home aged care, and reforms that support a future transition to a single in-home aged care system, and

• reforms to arrangements for pricing and funding hotel and accommodation costs in residential aged care, including the phasing out of refundable accommodation deposits.

Consultations close on 31 August 2023 and the Taskforce will provide an interim report to Government in October 2023 and a final report in December 2023.

The Social Services and Other Legislation Amendment (Strengthening the Safety Net) Bill 2023 has been assented on 10 Aug 2023.

This bill implements a number of social security measures announced in the 2023 Federal Budget including:

• expanding qualification for parenting payment (single) to single principal carers whose youngest child is aged under 14 years (up from under 8 years);

• increasing the rates of working age and student payments by $40 per fortnight, including jobseeker payment, youth allowance, parenting payment (partnered), austudy payment, disability support pension (youth);

• expanding eligibility for the higher rate of jobseeker payment to recipients aged 55 years and over who have been on payment for nine or more continuous months (reducing the qualifying age from 60 years); and

• increasing the maximum rates of Commonwealth rent assistance by 15 per cent.

These measures are scheduled to commence 20 September 2023.

July 2023

The ATO recently released data on the operation of the First Home Super Saver Scheme.

Among other statistics, it shows that in the 2021-22 financial year, approx. 12,500 members applied for a release request and approx. 9,500 members successfully received a payment under the scheme.

The data also details average processing times for First Home Super Saver release requests. In 2021-22, 86% of release requests were completed within 25 days.

This is inclusive of the:

• number of business days from the submission of the release request

• superannuation fund sending the FHSS amount to the ATO

• payment to the individual.

More information can be found on the ATO website.

The Government released a consultation paper on a new individual tax residency framework, which will replace the current individual tax residency rules. This initiative was originally announced by the former government in the 2021-22 Federal Budget, based on the recommendations made by the Board of Taxation in its 2019 report: Individual Tax Residency Rules – a model for modernisation.

The proposed framework introduces a 'bright line' primary test, which determines tax residency based on an individual's physical presence in Australia for 183 days or more during any income year. Individuals who do not meet the primary test will apply secondary tests to determine their residency status. These tests will be based on measurable, objective criteria with no requirement to test intention or undertake broad, holistic examinations of all relevant facts and circumstances.

Public feedback for the consultation paper is sought by 22 September 2023.2-63.

The ATO recently updated their online services simulator to include eight different clients’ super and tax scenarios. The purpose of the simulator is to allow individuals to test out the functions and features that ATO Online has to offer.

The simulator is strictly read only and can't be used to submit or change anything in a client's record. It doesn't interact with the ATO’s production systems and works on pre-set fictional data.

For more information, please go to ATO online services tool.

Some choice investment options, called Trustee Directed Products (TDPs), will be included in this year’s super performance test – and this could have a bigger impact than expected.

The complexity of determining which investment options are included in the test may mean unanticipated outcomes for some of your clients.

Our Head of FirstTech, Craig Day will be hosting a webinar to explain:

• The meaning of TDP's & which Choice options will be subject to the test

• How the performance test applies to TDP's offered through platforms

• What actions super fund trustees will be required to take where a TDP fails the test.

Craig will also be joined by George Walker, Executive Director, Investments – Distribution, who will provide more information on which of CFS’s Choice options will be subject to the test and how they are positioned against the test.

Online webinar details

• Tuesday 25 July 2023, 12.30pm Sydney time

• CPD points available

Register now

Prior to 1 July 2023, depending on its situation, an SMSF was required to report transfer balance cap (TBC) events either on:

• a quarterly basis (within 28 days after the end of the quarter) or

• an annual basis (at the same time as lodging the SMSF’s annual return for the year in which the TBC event occurred).

From 1 July 2023, all SMSFs must report most TBC events on a quarterly basis, within 28 days after the end of the quarter in which the event occurs.

Under these new rules, any unreported TBC events that occurred prior to 30 September 2023 need to be reported by no later than 28 October 2023. This means that an SMSF who was previously required to report on an annual basis must report any TBC events from 2022–23 by this date (and cannot wait until a later time such as when the fund’s 2022–23 annual return is submitted).

For further information about TBC event reporting for SMSFs, see this page on the ATO website.

June 2023

FirstTech Guides have been updated for 2023/24 - online versions now available:

• Super and Retirement Income Streams Guide

Printed Guides

You can now pre-order copies of the following printed guides using our new ordering process for delivery in August:

• Super and Retirement Income Streams Guide

New ordering process:

1. Go to: https://cfs-first-tech.qponline.com.au

2. Click on 'New User' under the blue 'Log In' button

3. Sign up for Your New Account

Complete the online ordering process

After ordering

• You will receive confirmation emails from Quality Press

• You can check your order history online at https://cfs-first-tech.qponline.com.au (Orders > Order history)

• Queries about your online order can be sent to sales@qualitypress.com.au

Please note, due to printing timeframes your new guides will not be delivered until August.

The ATO has issued draft guidance TD 2023/D1 on how the non-arm’s length income and capital gains tax provisions interact to determine the amount of statutory income that is non-arm’s length income.

When the final determination is issued, it is proposed to apply to years of income commencing both before and after its date of issue.

The last day for comments on draft TD 2023/D1 is 28 July 2023.

The ATO has provided updated information to assist individuals to work out if their military invalidity pension is affected by the Douglas decision.

The Federal Court decision in Commissioner of Taxation v Douglas [2020] FCAFC 220 (the Douglas decision) found that, from 1 July 2007, certain invalidity pension payments for veterans and their beneficiaries are superannuation lump sums, and not superannuation income stream benefits.

The ATO have advised that the vast majority of veterans will be in a better tax position due to the Douglas decision – paying less tax. Tax will increase for a small number of veterans.

As a result of the Douglas decision:

• a new veterans' superannuation (invalidity pension) tax offset> (VSTO) has been introduced to ensure veterans and their beneficiaries don't pay more tax because of the Douglas decision

• a simplified review process is available to amend prior year tax assessments for veterans – whether you pay less tax following the Douglas decision or are entitled to a VSTO amount.

The ATO have advised they are writing to veterans affected by the Douglas decision who will receive a new tax offset or are yet to request a review of their prior years’ tax returns.

May 2023

The Government handed down the Federal Budget for 2023-24 on 9 May. FirstTech has unpacked the Budget proposals and summarised their insights and analysis, including potential impacts to your clients' advice strategies.

Some of the proposals include:

• Super pay day

Tax increase for super balances over $3 million

• $20,000 instant asset write-off

• Energy Price Relief Plan

Download the FirstTech Federal Budget Briefing, 09 May 2023 here.

April 2023

We have made some security updates to the FirstTech App. As a result, iOS device (iPhone and iPad) users will need to update the app by 5 May to maintain access.

How do I update the app?

Updating the app is easy. Simply open the FirstTech app before 5 May and select Contacts, then FirstTech App updates, then Update.

To confirm the update has occurred, open the app and click the Disclaimer tab at the bottom of the home page. The version number should be v3.5.

What if I don’t update by the 5 May deadline?

If you don’t update the app by 5 May you will get an error message saying “FirstTech is no longer available”.

To resolve this simply open this email on your device and then click here and follow the steps to download the app.

To confirm the update has occurred open the app and click the Disclaimer tab at the bottom of the home page. The version number should be v3.5.

What if I am an Android user?

If you are an Android user, you don’t need to do anything. You only need to update the app if you access it via an iOS device.

Don’t have the app yet?

The FirstTech app gives you easy access to the latest rates and thresholds for superannuation, tax and social security. It also includes a handy Centrelink pension calculator.

To download the FirstTech app, click here on your Apple or Android device and follow the steps to download the app.

The Federal Budget for 2023-24 will be handed down on 9 May 2023.